It doesn’t get more real-world in math than Personal Financial Literacy! I appreciate that real life concepts that impact growing teens and adults are incorporated into Texas state standards.

Today, I am sharing ideas that support the personal financial literacy standards for middle school.

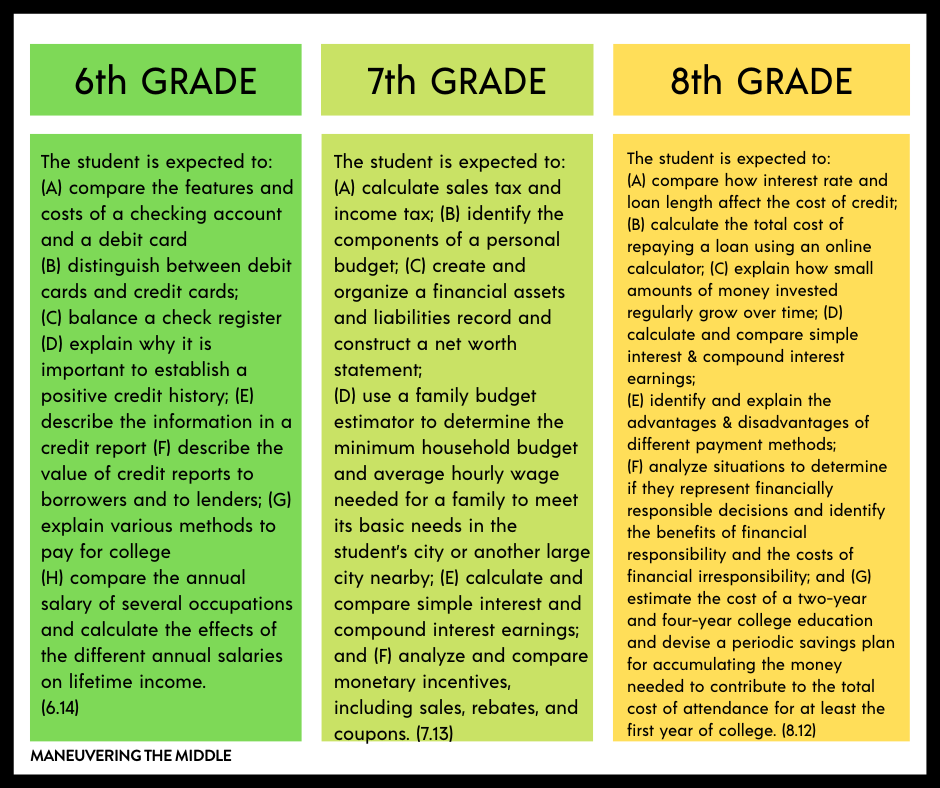

Let’s take a moment to at what is included in the Texas Personal Financial Literacy standards. *The standards below have been edited for conciseness.*

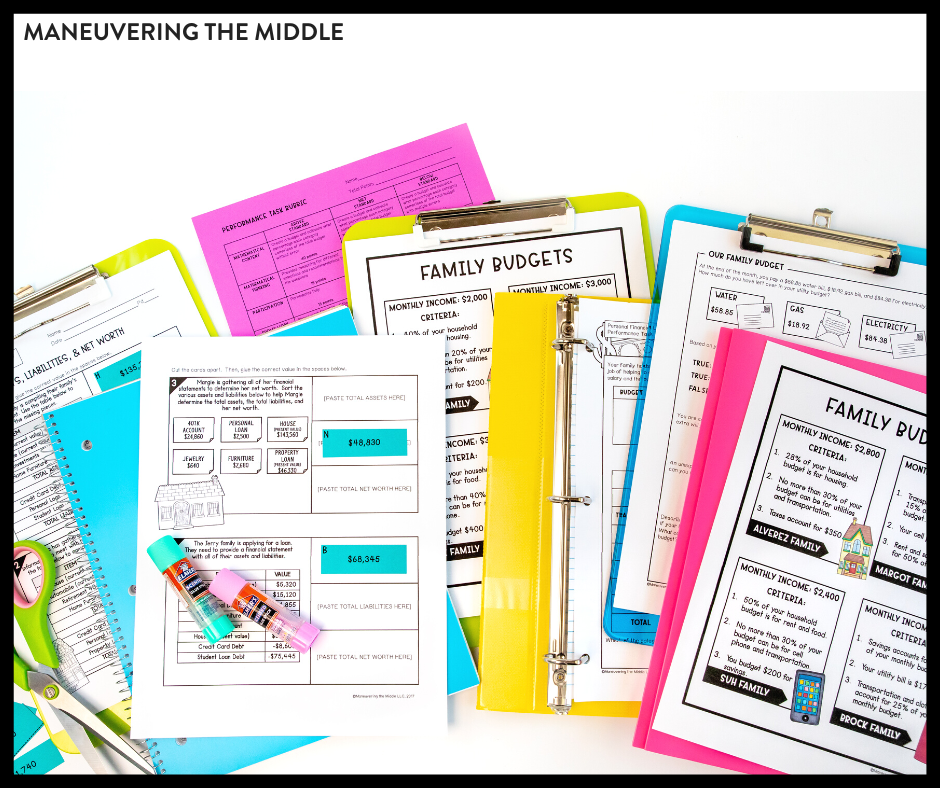

Comprehensive curriculum that is aligned to the TEKS can be a challenge to find. Fortunately, Maneuvering the Middle has already created the student handouts, homework, study guides, and assessments for this very subject.

In addition, Maneuvering the Middle has already created a variety of activities – scavenger hunts, card sorts, solve and color, online exploration activities, stations, and more to provide practice and keep Personal Financial Literacy engaging.

Think Long-Term

Remember that while we do teach the standards, we can emphasize the most long-term concepts. While sixth grade calls for students to be able to explain the items on a credit report, we really want students to have a great understanding for what a credit report is and how short-term poor decisions can impact us for a long time. In 8th grade, this concept is driven home with the emphasis on ways to save money with interest over time. To me this is a great takeaway for middle schoolers!

Make It Relevant

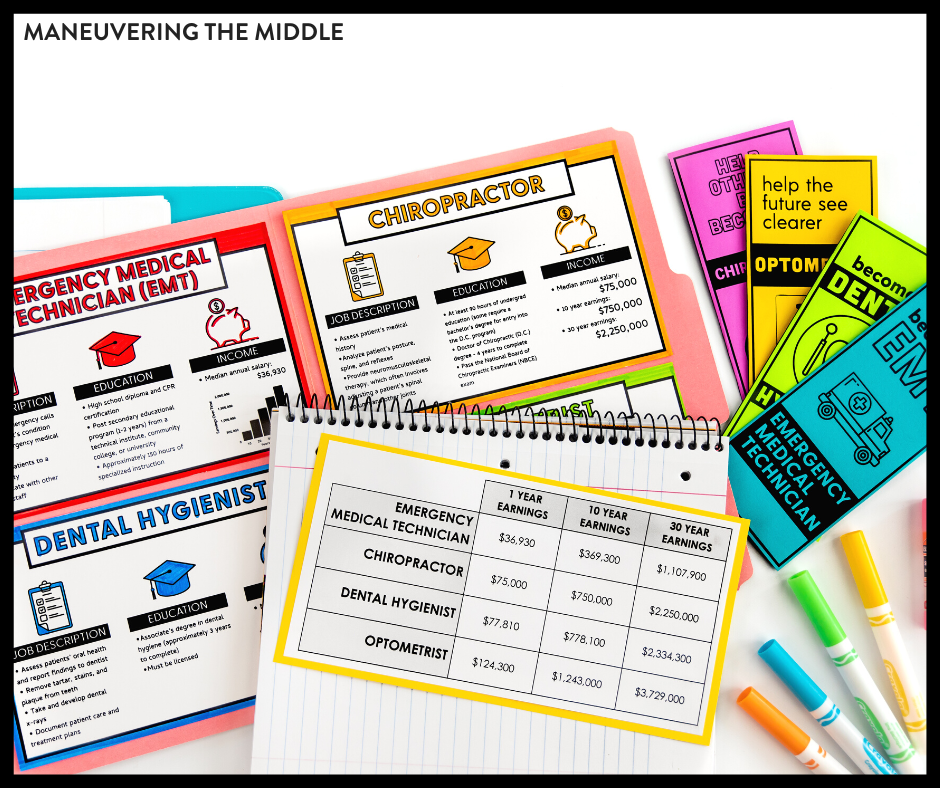

I appreciate the vertical alignment of specific strands, specifically G and H. Sixth graders look at the larger scope of how career fields impact your lifetime income, 7th graders explore just how expensive it is to maintain a household, and lastly 8th graders are asked to devise a savings plan for college. This strand shows how personal this concept is to students’ futures. This is something that you will use in the real world (*gestures wildly*).

Activities to Try

Dollars and Sense – This free activity is similar to the game of Life. While it isn’t ink friendly, you could laminate and have a class set. Students choose a career, and have various opportunities to flip a coin to either incur a costly expense or financial favor. They decide how to spend and save their money on transportation, clothes, and housing. At the end of the game, they have to fill out a budget based on their choices. This is aligned to 6th, 7th, and 8th grade standards.

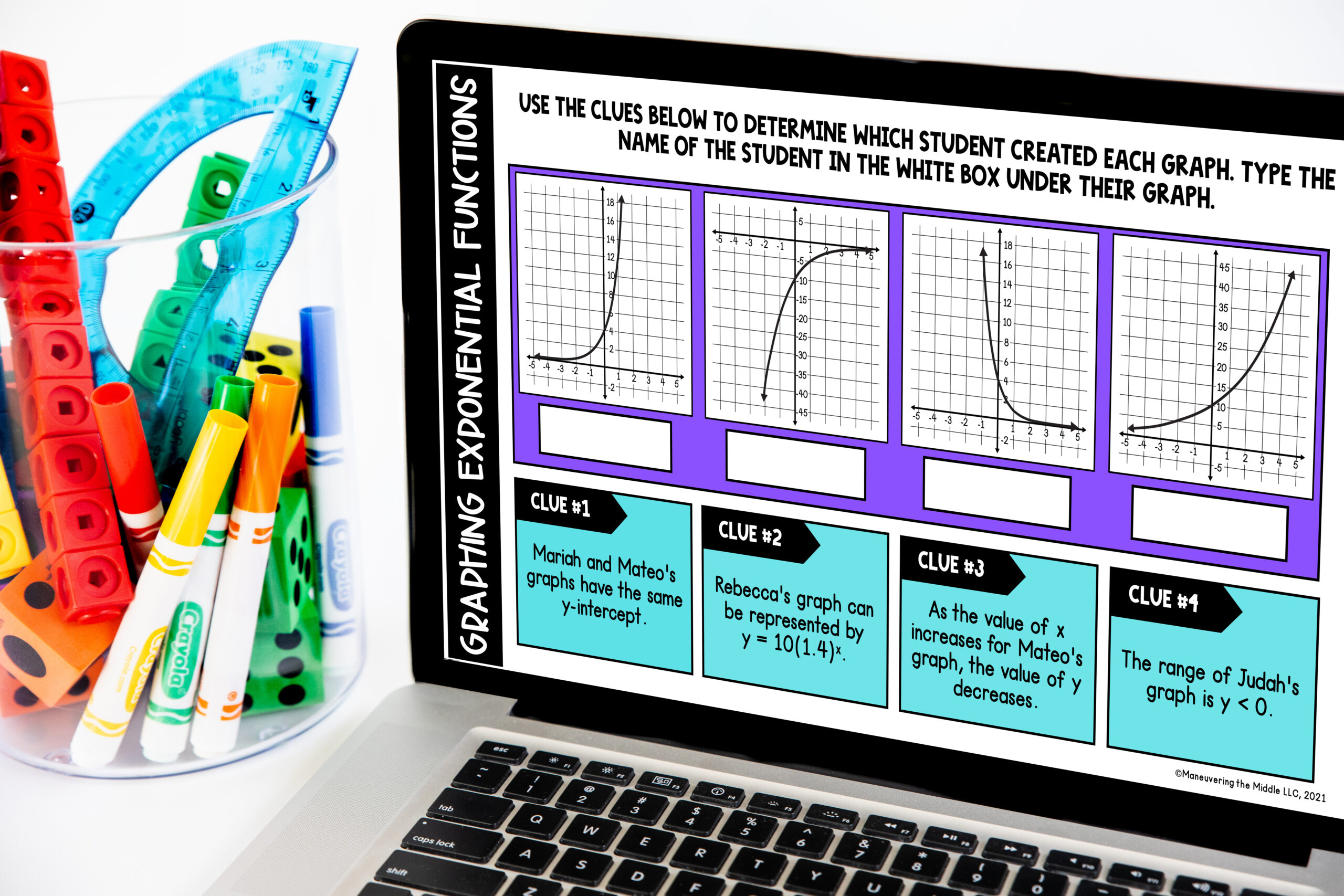

Financial Football – This computer-based activity requires students to answer financial multiple-choice questions between plays. The football aspect will engage some students, and it isn’t 100% aligned to one grade level’s standards, but overall, I think this would be a great extension for students over the course of the unit.

Comparing Salaries in Various Fields Project – In this project, students will research and compare annual salaries of various careers requiring different levels of education and calculate the effects of different salaries on lifetime income. The project even allows for a career fair! This project is directly aligned to TEKS 6.14G and 6.14H.

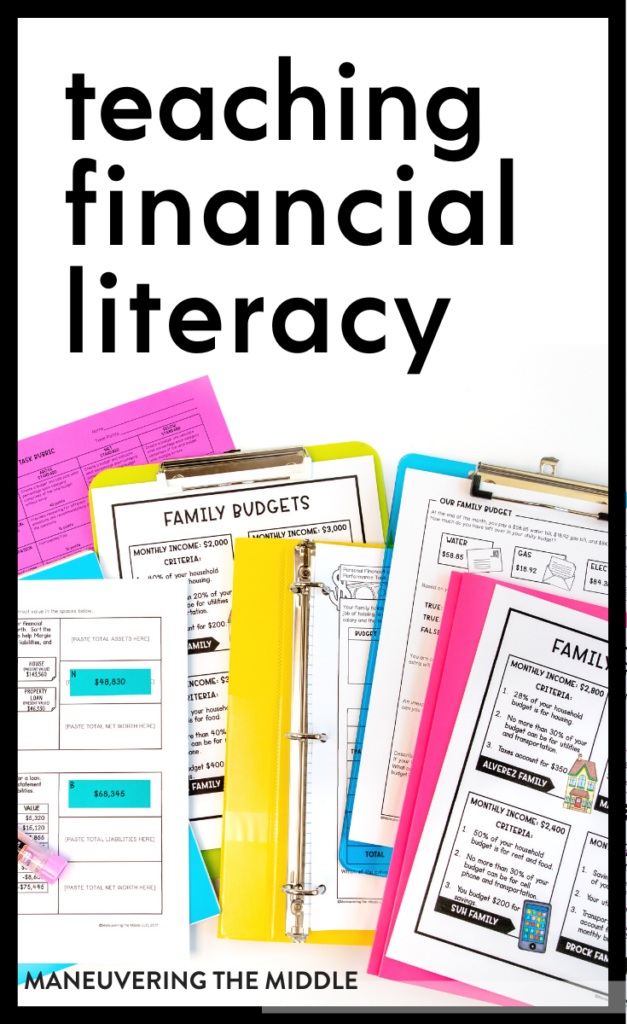

Real-Life Bills – Similar to Price of Right games, give students a category – water, electricity, cable, phone, rent, groceries, etc – and have groups guess what the average or median cost of those types of bills would be. You can use your own bills as a reference or Google averages in your area.

Household Budgets and Percent Practice – Students will take on the role of an employee working for “Remote Possibilities”, a company that helps clients who work remotely to determine the best location to live based on the client’s income, financial goals, and lifestyle desires. Students will understand and apply concepts of personal budgets and minimum household budgets. This project is directly aligned to TEKS 7.13B and 7.13D.

Planning and Saving for College Project – Students will take on the role of a financial advisor working for Scholarly Savers, a company that counsels families through various financial situations. Students will research the cost of colleges and create a savings plan for a fictional client. This project is directly aligned to TEKS 8.12G and 8.12C.

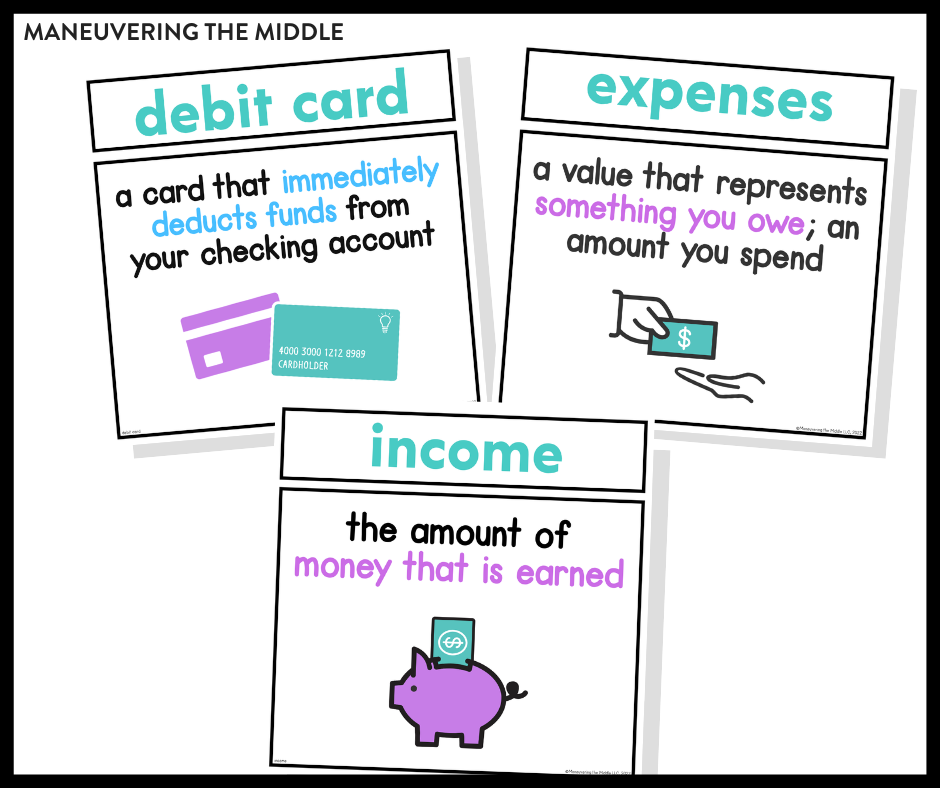

EMPHASIZE VOCABULARY

When writing the units and really digging into the standards, I was blown away by the level of new concepts and terms that are introduced. Ask students to use the academic vocabulary, and spend a few minutes at the beginning of each class reviewing. To spice it up, you could do a quick fly-swatter game, Quizizz, or Kahoot.

The 6th grade standards have 10 new vocabulary words introduced! For comparison, most units average around 5.

Common Misconceptions

Overall, I think the biggest challenge is that while these terms are familiar to us as adults, they are foreign to students. Credit reports? Grants? Work-study? Like I said before, this unit is probably the most vocabulary dense unit in middle school math.

- Grants are needs-based, while scholarships are needs- and merit-based

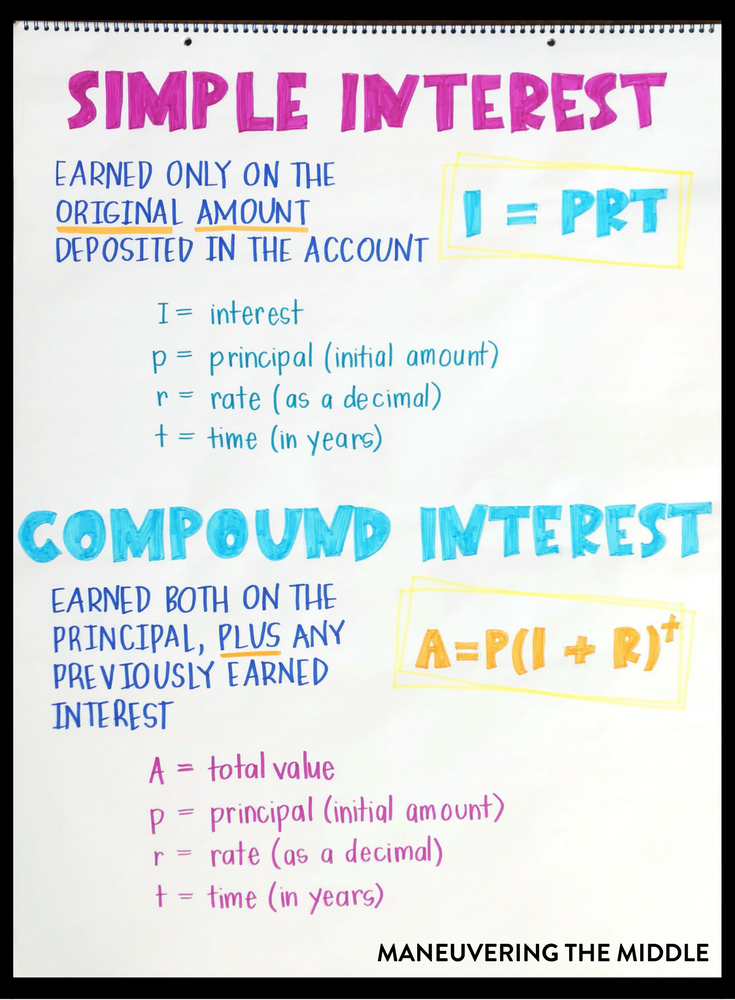

- Confusing total value with interest in the compound interest formula

- Confusing the terms “assets” and “liabilities” on a net worth statement

- A debit card is different that than the verb, “debit”

Anchor Chart

Anchor charts are fabulous ways to showcase the content in a visual manner for students to reference. They can easily be created before the lesson or as you are teaching, depending on the content.

Do you have any other great ideas for teaching the personal financial literacy standards?

Maneuvering the Middle has been publishing blog posts since 2014. This post was originally published in March 2018. It has been updated for relevance and clarity.

Completely agree! I push in to an 8th grade class as an RTI Math Intervention Specialist and was asked the question, “What is your opinion on credit cards?”. While I learned several teacher responses were “no, don’t”, I actually answered the pros and cons. Pro – Credit Scoring, Building Credit, etc. and Cons – Do not open one when you do not have a job that can pay for it, Interest rates are high, etc. These ideas had not been presented as reasons why one would use.

Plus, many students learned that day that using their mom’s or dad’s card may or may not be a debit or credit card. They have memorized numbers, used the cards, and had no idea what they were costing their parents. This was a great lesson to core teacher reviewed with students.

Knowledge is power! Thanks for your comment!